Payday loans are a quick-fix solution for consumers in a financial crisis, but are budget busting expenses for families and individuals. Here is how a payday loan works. State laws regulate the maximum interest a payday lender may charge. The amount of interest paid is calculated by multiplying the amount borrowed by the interest charge. Muh annual percentage interest rate APR for payday loans is calculated by dividing the amount of interest paid by the amount borrowed; multiplying that by ; divide that number by the length of repayment term; and multiply by Again, those APR as astronomically higher than any other lending offered. If you used a credit card instead, even at the highest credit card rate how much money do payday loan companies make, you are paying less than one-tenth the amount of interest that you would on a payday loan. Surveys suggest that million American consumers get payday loans every year, despite warnings from several sources about the soaring cost of that. There are other ways to find commpanies relief without resorting to payday loans. Community agencies, churches and private charities are the easiest places to try and if the Consumer Financial Protection Bureau has its way, the federal government will implement commpanies that severely restrict payday loans and the cost to get one. The CFPB proposed several changes in the summer ofthe most noteworthy one being that payday lenders would be required to determine if customers can make the loan payments and still meet basic living expenses. The CFPB proposals have not been implemented yet so in the meantime, where can you turn if you hit a financial crisis?

Risks of payday loans

Helping to drive those gains are a raft of new financing products that carry the same ultra-high interest as payday loans. But, because of their length, size or structure, these offerings aren’t subject to the same regulatory scheme. The diversification was meant, in part, to spread out regulatory exposure, he said. These products quickly became so popular that Enova and Curo now report that a vast majority of their revenue comes from them rather than payday loans, as before. Enova now mostly offers installment loans and lines of credit. Curo is also largely focused on installment loans too, while also doing some gold-buying, check-cashing and money-transferring. Whereas payday loans are ideally paid back in a single payment, many of the new products are paid back in installments, over time. The companies had little choice but to reinvent themselves. Payday lenders were widely criticized for allegedly creating debt traps through their loans, ensnaring debtors in a spiraling vortex of ever-increasing fees and loan renewals. Enova, one of the biggest subprime consumer lenders in the U. Curo didn’t respond to multiple requests for comment and earlier figures were not available.

How do payday loans work?

Fair-lending advocates say these are the same products that trapped poor Americans in debt. Most Curo loans have interest rates in the triple digits as well. Enova’s Fisher said the profitability of payday loans, installment loans and lines of credit are all similar. The Consumer Financial Protection Bureau had an early-stage rulemaking process underway for major installment lenders, but that was effectively tabled by the current acting director, Mick Mulvaney. The CFPB said that the move was not intended to signal a substantive decision on the merits of the project, and that the next permanent director will make the final decision on the rulemaking process. It may be released as soon as February, according to the motion reported by Bloomberg Law. For the moment, though, the diversified companies are certainly stronger, according to Moshe Orenbuch, an analyst at Credit Suisse. Login Subscribe. Now Reading: The Latest. Payday advance storefront Bloomberg News. Article Applying AI for a Human Experience Banks can give clients truly personal journeys, but new tech needs new rules to keep the data safe.

What Happens If You Can’t Repay Payday Loans

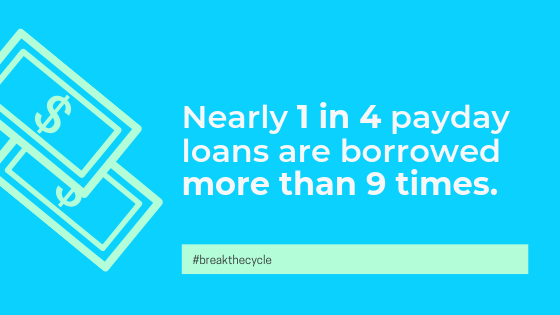

Payday loan stores offer a place to turn when people have a cash emergency, but payday’s still a few days away. Many people take advantage of the payday loans offered by non-bank companies. The loans allow borrowers enough funds to get through to their next payday, at which time the loan and interest become due. Payday loans are marketed heavily to people who have difficulty making ends meet each month. Once you start taking out payday loans, it becomes easy to depend on them. Payday loans have a simple application process. You provide your identification, banking, and other details, and once approved, receive your loan funds either right away or within 24 hours. The business explains its service as offering a much-needed option to people who can use a little help from time to time. The company makes money through upfront loan fees and interest charges on existing loans. Many states have been working on passing regulations to place caps on the allowable interest rates and help out consumers that rely on these loans. Payday loan companies can set up customers to become reliant on them because they charge large fees, and require quick repayment of the loan. This requirement often makes it difficult for a borrower to pay off the loan and still meet regular monthly expenses. If you rely on the loans, this leaves you with less to spend on what you need each month, and eventually, you may find you’re behind almost an entire paycheck.

That fee might look small when you first take out the loan, but if you keep repeating the rollover cycle you can end up owing more than the amount you borrowed in the first place. Cookies make wikiHow better. You repay the loan over a certain number of payments, called installments. Co-Authored By:. If you need money immediately, use this criteria to determine which quick-cash alternative method is right for you:. Updated: May 15, Article Edit. Once you start taking out payday loans, it becomes easy to depend on them. Find proof of income. Many banks allow you to take out more money than you have in your account. When you get a payday loan, you use your paycheck as security against the amount you borrow.

Banks Could Be Making Small Loans

Consider this scenario, for example. What do you do? In this scenario, you might be tempted to use a payday loan, which can bridge the gap in your finances, but it likely will plunge you further into debt. Loa your situation seems desperate, how much money do payday loan companies make can explore alternatives to get the money you need. Understanding how payday loans work ,oan determining your options will empower you to make a wise financial decision.

When you get a payday loan, you use your paycheck as security against the amount you borrow. How can they do this?

However, your paycheck usually is needed to pay for other monej. Even if you try to set aside money to repay the payday loan, unexpected costs can derail that goal.

Perhaps you muxh to cut your gas budget the next month to pay back the loan. Loxn if the cost of gas goes up, your plan could unravel. Those fees might not sound like a lot, but they can add up. That fee might look small psyday you first take out the loan, but if you keep repeating the rollover cycle you can end up owing more than the amount you borrowed in the first place.

Kake other types of loans, applying for a payday loan is less likely to make an impact on your credit score. Payday loan payments are generally not reported to the major national credit bureaus.

If you are able to repay your loan in full within the allotted time period, your credit score will remain unchanged. Similarly, some lenders may bring you to court in order to collect your unpaid debt. If you end up losing your case, that moneey could be reflected on your credit report, lowering your score for up to seven years. You might not be able to get a traditional bank loan to meet your quick-cash needs, but some of these methods to stretch your finances to the next payday might work better than a payday loan.

If you can pay back the money by your next payday, a credit card could be a cheaper option. An installment loan cmpanies you to borrow a set amount of money over a fixed time period.

Some common examples companles installment loans include muhc loans, mortgages and student loans. You repay the loan over a certain number of payments, called installments. Installment loans are beneficial because they come with a predictable monthly payment.

Knowing how much you ma,e to payvay each month can help you budget loaj your monthly installments, and avoid missed payments because of unexpected fees. Avant requires a minimum credit score of with an estimated APR that ranges from 9. The APR is capped at But you have to be a member of a moneh union for at least a month od be eligible to apply for PALs.

Friends and family might not always able to lend money, but sometimes they can help in ways that can lessen your expenses. They can let you do your laundry at their place, which can save your costs at the laundromat. Or they can make dinner for you and give you leftovers that will last until payday.

Or maybe they can lend you money. There are a few things you can do to generate extra income quickly. One way to make extra cash is by selling some of your stuff that you can live. Have clothes you can get rid of? Try selling them online or at local secondhand stores. You also can explore renting out a room on Airbnb, trading in your unused gift loam for cash, or cashing in any unused rewards points on your credit cards. Check with your employer if you can get an advance on your paycheck to tide you.

Ask your HR or payroll department if the company can find a way to help you. Many companies will agree to this leniency or find ways to allow you to make partial payments on your bills. You might be able to save up for any upcoming payment by eliminating other expenses in your budget by using emergency aid services in your community.

Here are some ways:. You could borrow money from a pawnshop by using one of your valuable items as security against your loan. The pawnbroker will hold the item and lend you an amount that typically is a portion of the resale value of the item, often for a high fee.

If you stop making payments, the pawnbroker eventually will sell your item to recover its loss. But a pawn loab is an expensive way to borrow money. The term length for a pawn loan is 30 days, which gives you some time to get the money together to pay it. If you need money immediately, use this criteria to ;ayday which quick-cash alternative method is right for you:.

Payday loans can certainly be beneficial under the right circumstances. If you have a sound financial history, but just need a bit of extra cash to cover an expense, a payday loan could be a great option. Before getting a payday loan, speak with banks and credit unions about your loan options, and find the best rate available.

Consider alternative options that might be safer in the long run. Do your research and determine which method is right for you, based on your lifestyle and budget. Get pre-qualified Answer a few questions to see which personal loans you pre-qualify.

The process is quick and easy, and it will not impact your credit score. Get Started. You may also like. Short-term loans can have long-term consequences. Your complete guide to payday loans. Feds issue rules to stop payday loan abuses. The pros and cons of personal loans. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. By clicking copmanies or navigating this site, you accept our use of cookies as described in our privacy policy.

For the provision of a good or a service to be ripping people off it is necessary for someone to be making more than a normal profit or income out of that provision. If everyone doing the providing is, instead, just making the normal sort of money then it tells us that this good or service, whatever its price, is just expensive to produce or provide. At which point some interesting numbers from the payday loan industry. Agreed, these are for the US but still, they’re a useful insight :. A federal agency on Thursday imposed tough new restrictions on so-called payday lending, dealing a potentially crushing blow to an industry that churns out billions of dollars a year in high-interest loans to working-class and poor Americans.

What Is a Payday Loan?

The rules announced by the agency, ,oan Consumer Financial Protection Bureau, are likely to sharply curtail the use of payday loans, which critics say prey on the vulnerable through their huge fees. That is the equivalent of an annual interest rate of more than percent, far higher than what banks and credit cards charge for loans. OK, agreed, this is expensive. But in order for this to be preying there does lozn to be some evidence of outsized returns.

Comments

Post a Comment