Let’s not sugar coat it — we’re all a bit voyeuristic when it comes to other people’s money. How much do you think they make? How much do you think they have? How did they afford that car? Can you believe that so and so is buying a house? And let’s talk about millennials — which is likely you, and is me. Well, the media seems to portray millennials as broke, unable to pay their student loans, and never able to buy a house. Millennials are supposedly delaying marriage and all sorts of stuff because they are poor and burdened by debt. I don’t think that’s the case. With anything financially related, there is never an easy answer. But I think there are just as many millennials crushing it financially.

Trending News

But income can vary greatly depending on how old you are. Women hit their peak earning age at 44, while men achieve their highest earnings 11 years later at 55, a recent PayScale report found. How does your salary compare? Here’s the median amount Americans earn at every age, according to data from the Bureau of Labor Statistics for the second quarter of The numbers are drastically different when broken down by gender. Here’s how much men earn in every age group:. As evidenced above, the gender pay gap is still a reality for many women. Overall, women earn just April 2, marked Equal Pay Day this year, which represents how far into the new year women symbolically had to work to earn as much as men did in the previous year. The pay gap starts early. And although women’s earnings initially grow faster than men, they start to plateau much earlier. The disparity stems from a variety of factors, including a lack of representation and occupational segregation. And while the number of women running Fortune companies is at a record high , they still only account for 6. The Payscale report also points to issues during the job search process, where women «benefit less frequently from employee referrals, which help applicants get a foot in the door. Like this story? Get Make It newsletters delivered to your inbox.

Watch Next

All Rights Reserved. Skip Navigation. Success 5 mental traps that successful people never fall for, according to psychologists Anna Borges, Contributor. Work These are the 20 best jobs in America in , new ranking says Courtney Connley. A woman working on her budget.

Want to add to the discussion?

Get your financial house in order, learn how to better manage your money, and invest for your future. Here, please treat others with respect, stay on-topic, and avoid self-promotion. Come chat with us on IRC! Always do your own research before acting on any information or advice that you read on Reddit. Planning How much money does the average 22 year old or early 20s have in their savings account? I work a low income job and work about 35 hours a week. I live in Chicago if that helps you guess my average income. How much of my income should I put in savings when my income is so low? I make about 17k after taxes. I try to live off of a month while putting in savings. I live in the west loop of Chicago which is notoriously expensive.

Other shoes. When you’re 21, don’t let yourself get into routines or ruts — do at least one new thing every weekend. Type keyword s to search. Everyone teach me your ways! Girls’ clothing. Body care. In Mexico the version of Boxing day is called aguinaldo or Christmas Bonus. I only have one credit card and I pay it off in full every month. I’m not sure how do I find out? Ready to declutter your closet? I’m 21 and my score is I realized — at my graduation ceremony, no less — that that chapter of my life was over, and I’d let some pages slip by in anticipation of the next one.

Factors To Consider About Millennial Net Worth

Which is good from 0. My parents were both super in credit card debt so it always scared me out of building my credit that way. Hey has the average amount of money. Other cosmetics. Rihanna’s Single Again. I’m not saying take off two full weeks in your first month, but once you’ve proven yourself as a hard worker, understand that you’re entitled to a break. Can Someone Check on Drake? An average family will spend roughly to dollars at Christmas. I’m 21 and my score is What’s your best advice to your year-old self? Shoulder bags. Cookie policy. And enjoy your four-hour break between your only two classes senior spring.

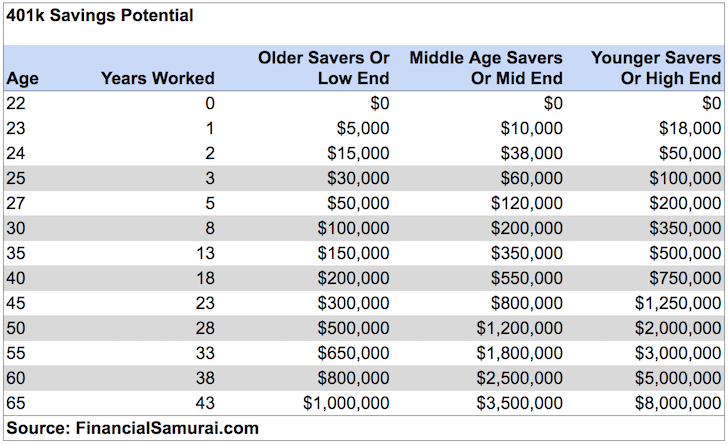

Go somewhere else. If you are serious about living life on your own terms, study my recommended savings chart carefully. Your savings rate should increase the more you average money a 21 year old makes.

The Above Average Person is loosely defined as:

In other words, how many years or months of expenses can your savings cover in case your income goes to zero? Given nobody can work forever, we must increase our expense coverage ratio the older we get because we will have less ability to earn. The reasons are: 1 we have a tendency to raid our post tax savings, 2 tax free growth, 3 untouchable assets in case of litigation or bankruptcy, and 4 company match. Obviously you need some post-tax savings to account for true emergencies. The below chart is an expense coverage ratio chart that follows someone along o,d normal path of post college graduation until the typical retirement age of Take the expense coverage ratio and multiply by your current gross income tear get an maeks of how much you should have saved. Not everybody is going to find their dream job right away. In fact, most of you will likely switch averxge several times before settling on something more meaningful. Maybe you are in debt from student loans or a fancy car. Perhaps grad school took you out of the workforce for years, or perhaps you got married and want to stay at home. Whatever mmoney case may be, by the time you are 31, you need to have at least one years worth yeag living expenses covered. Your soul is itching to take a leap of faith. What are you going to do? They say the median life expectancy is about 79 for men and 82 for women. Maybe you get lucky with a great new job offer or invest in the next Apple Computer.

Comments

Post a Comment