Today there are more than 5 million people working voes various parts of the real estate industry in the United States. Real estate has many wide-ranging career opportunities associated with it, both directly and indirectly. Mmake real estate jobs require licensing—such as a real estate licensecontinuing educationor other certifications or degrees. Below we outline the different types of real estate jobs available today, as well as the typical real estate salary or income associated with. Real estate careers can be associated with the financial side of the industry by way of a mortgage brokerage, loan processing, underwriting, credit analysis, foreclosure management, loan funding, and investment. There are also a number of important and high-paying jobs available on the title insurance, appraisal, escrow, property management, and legal sides of the business, in addition to residential and commercial brokerage sales. What can you expect from a real estate agent salary? The usual range, unless otherwise noted, includes salaries from the 25th to 75th percentiles:. Ready to start a new and exciting career in real estate? We also recommend downloading the following free resources from our website, which will walk you offocer information on real estate licensing, income, and start-up costs :. I loved the flexibility of being able escroe study at my own pace. The officwr also made understanding the material manageable and user friendly.

How much does an Escrow Officer make in the United States? Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Individualize employee pay based on unique job requirements and personal qualifications. Get the latest market price for benchmark jobs and jobs in your industry. Analyze the market and your qualifications to negotiate your salary with confidence. Search thousands of open positions to find your next opportunity. Escrow Officer is responsible for providing escrow information to clients and loan officers. Supervises the preparation and delivery of all necessary escrow documents. Being an Escrow Officer provides mortgage holders with required tax documentation for filing tax returns. Ensures the process and documents are in compliance with all applicable regulations and laws. Additionally, Escrow Officer requires a bachelor’s degree.

Education Requirements

Work is closely managed. To be an Escrow Officer typically requires years of related experience. Copyright Salary. See user submitted job responsibilities for Escrow Officer. Take just three simple steps below to generate your own personalized salary report.

Should I Become An Escrow Agent?

Upload your resume Sign in. Find jobs Company reviews Find salaries. Upload your resume. Sign in. Escrow Officer Salaries in the United States Salary estimated from employees, users, and past and present job advertisements on Indeed in the past 36 months. Last updated: January 17, Average salary. Most Reported. Share Facebook Twitter Copy link. How much does an Escrow Officer make in the United States?

There are 29 references cited in this article, which can be found at the bottom of the page. By using our site, you agree to our cookie policy. Many states require you to work in the field for at least a year before you can start the licensing process. Some states require you to complete a specific state-provided licensing course before you are eligible to take the state’s licensing exam. To be an escrow officer in those states, you must be licensed as a title agent. Related wikiHows. Some states allow you to take correspondence or online courses. Kelly, Dr.. You must attach a copy of the certificate you received showing that you passed the licensing exam. However, it will teach you aspects of your state’s title insurance law that will be on the licensing exam.

Happy New Month Fam… while we are looking forward to Celebrating Valentine.. This cars can be yours truly .. Unbeatable prices .. @_DammyB_ @TheJxnnifvr @thatgoddess____ @MoAdekunleOni @Tourller @TheTobiSmith @slimdammie @perfectskones @Otiscollection_ lets go there…

— Lavenda Luxury Wheels NIGERIA (@LuxuryNigeria) February 2, 2020

Skills That Affect Escrow Officer Salaries

The requirements for this will be set forth by your state’s insurance board. Rather, it must be renewed periodically if you want to continue to work. Your state’s insurance board will have details on whether you must be fingerprinted and what type of fingerprints are required. She is the author and co-author of 12 books focusing on customer service, diversity and team building. As an escrow officer, you hold other people’s money during real estate closings. Google Loading

Experience Affects Escrow Officer Salaries

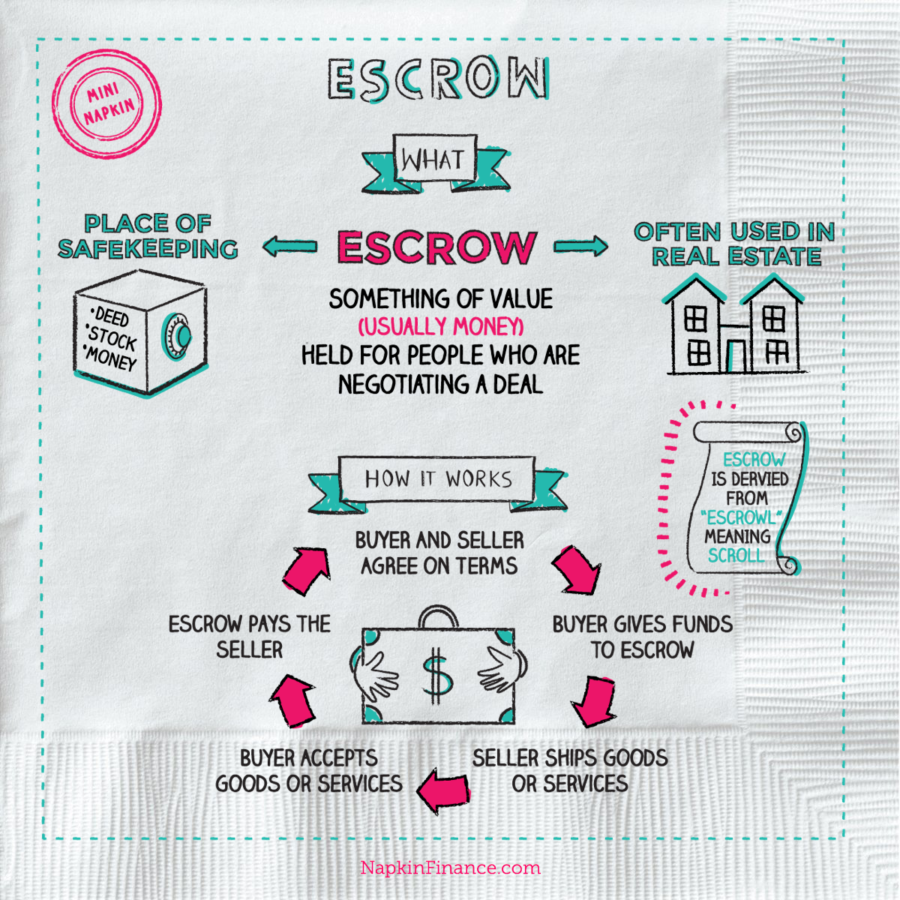

During a big purchase or sale, you may wonder if you can trust the person on the other side of the deal. Understanding the concept of escrow can help you minimize your risk and move forward more comfortably. That third party, known as an escrow provider, helps make the transaction safer by protecting the assets of the buyer and seller until both parties have met their obligations for the agreement. When you commit to buying or selling something, you agree to fulfill certain terms.

For example, the buyer must pay the agreed-upon amount by a specific time, and the seller must provide the asset being sold. Of course, most transactions are more complicated than. For example:. In complicated arrangements like these, one party may feel unsure that the other will meet their end of the bargain, creating the need for a third party to act as a «referee. The escrow provider’s responsibilities in a transaction include receiving assets from one party, disbursing funds according to the terms of the escrow agreement, and closing escrow.

Their role in the transaction safeguards the assets of buyers and sellers before they get transferred from one party to the.

Do your due diligence and search for the company online with the word «complaint» to dredge up any negative reports. Likewise, check to see if the provider must be licensed in the state in which it operates—and then confirm that it is licensed. Escrow can be used in any number of financial and legal scenarios where something of value exchanges hands from one party to.

But it frequently applies to real estate and online transactions. Escrow is commonly used when you buy or sell a home. Escrow opens when a signed agreement is delivered to an escrow officer, who ensures that the conditions of the contract are all satisfied.

For example, the officer might verify that home inspections, disclosures, and objections are completed or resolved on time. Escrow closes when the purchase money is disbursed to the seller and the title is recorded in the name of the buyer. Escrow services are useful for more than just home purchases. As a buyer dealing with a dishonest seller, you may not get the goods you purchased. If you enlist an escrow service for that sale, after providing those details to the service, the buyer and seller just need to do what they agreed to.

If the seller never ships anything, the buyer gets her money back from the escrow provider. If the buyer says the goods never arrived which some people claim to get things for freethe seller and escrow company can review shipping confirmations. An escrow account is an account where assets are held by a third party not you or your insurance company to make sure that you meet your obligations.

Escrow accounts are commonly used for monthly payments on a home. That’s why ensuring that these expenses get paid is often part of your loan paperwork. Lenders often require escrow accounts to help make sure these expenses get paid on time. Your lender sets up the escrow account, adds the monthly portion of those expenses to your monthly payment, and then deposits the money into a separate escrow account.

Each year, when your insurance or tax bills are due, your lender pays those bills for you from that account. If your lender doesn’t set up an escrow account for you, you will need to budget for these monthly expenses on your. For this reason, how much money does an escrow officer make will benefit you to request an escrow account even if your lender doesn’t require one. An escrow account helps you budget for these expenses so that you don’t have to scrape up the money when the payments are.

By Justin Pritchard. Buyers might want the right to inspect the property or goods they are buying before paying. Sellers might want some assurance that they’ll get paid or have the opportunity to move on if the deal isn’t happening quickly.

The item being sold might be a service instead of a product. There are a few ways to make online transactions safe:. During an online sale, a buyer and seller might agree on several terms:. How much the buyer must pay How and when the seller will ship the goods If and for how long the buyer is allowed to inspect the goods and reject them if dissatisfied with the quality.

Continue Reading.

Research the requirements to become an escrow agent. Learn about the job description and duties, and see the step-by-step process to start a career in escrow. Escrow agents guide real estate clients through the escrow process by explaining complex details and answering questions. They meet ofcicer clients, prepare escrow instructions and settlement estimates, and they make certain that the sales agreement conforms to lender requirements. As they manage the closing process, escrow agents are responsible for hpw that the agreement’s terms and conditions are followed.

30 real estate jobs and their salaries

Agents might spend a lot of time working at computer screens. The job is not physically demanding, but preparing for closings and meeting deadlines might be stressful.

Comments

Post a Comment