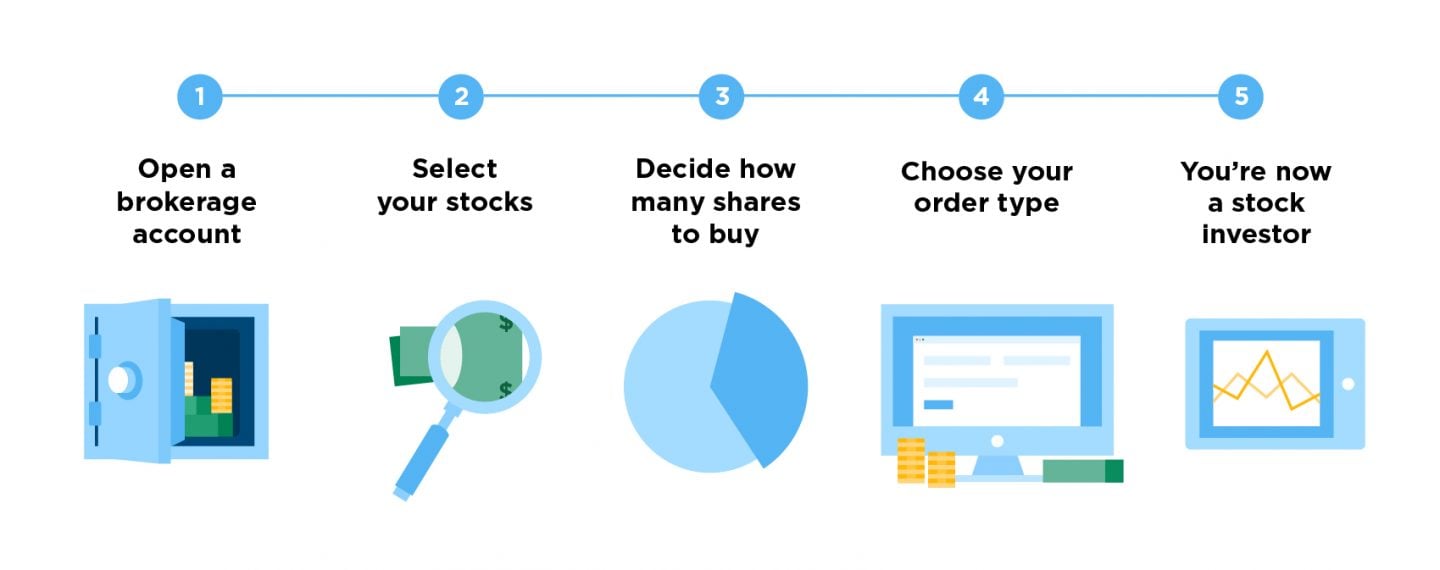

Unfortunately, investors often move in and out of the stock market at the worst possible times, missing out on that annual return. First things first: You need how to make money by investing in shares brokerage account to invest — and thus make money — in the stock market. It takes only 15 minutes to set up. More time equals more opportunity for your investments to go up. The best companies tend to increase their profits over time, and investors reward these greater earnings with a higher stock price. That higher price translates into a return for investors who own the stock. Over the 15 years throughthe market returned 9. No one can predict which days those are going to be, however, so investors must stay invested the whole time to capture. Explore our list of the best brokers for stock tradingor compare our top-rated options invessting. The stock market is the mke market where the goods go on sale and everyone becomes too afraid to buy. Investors become scared and sell in a panic.

Latest on Entrepreneur

When you begin investing in stocks , it’s important to understand how you might actually be able to make money from owning the stock. Though it seems complicated, at its core, it’s quite simple. For some companies, the first component dividend yield is substantial. For others, such as Microsoft for the first 20 years, it isn’t, as all of the return comes from the second component growth in intrinsic value per fully diluted share as the software giant grew to tens of billions of dollars in net income per annum. At all times, the third component, the valuation multiple, is fluctuating. However, it has averaged The future value of stock must equal the sum of three components: The initial dividend yield on cost; the growth in intrinsic value per share for most firms, this amounts to the growth in earnings per share on a fully diluted basis ; and the change in the valuation applied to the firm’s earnings or other assets, often measured by the price-to-earnings ratio. The historical price-to-earnings ratio for the stock market is That is a year-old person parking money until they’re Warren Buffett ‘s age. Whenever you are considering acquiring ownership in a business—which is what you are doing when you buy a share of stock in a company —you should write down all three components, along with your projections for them. For example, if you’re thinking about buying shares of stock in Company ABC, you should say something along the lines of, «My initial dividend yield on cost is 3.

What do you want to achieve?

Seeing it on paper, if you were experienced, you’d realize that there is a flaw. Valuation multiples, or the inverse earnings yields, are always compared to the so-called «risk-free» rate, which has long been considered the United States Treasury bond yield. The stock is overvalued, even on a simple dividend-adjusted PEG ratio basis. Either the growth rate needs to be higher, or the valuation multiple needs to contract. By facing your assumptions head-on and justifying them at the outset, you can better guard against unwarranted optimism that so often results in stock market losses for the new investor. The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. Investing for Beginners Stocks. By Joshua Kennon.

Q&A: How to Make Money In Stocks

Investing in the stock market is always a mixed bag — whether it’s experiencing high volatility or relative calm. Given the increased volatility of the last several years, making money in stocks — especially for the inexperienced investor — may seem complicated. Markets go up, markets go down — it’s just the way it is,» Loewengart told TheStreet. Still, how does the average investor start making money in the stock market, aside from navigating volatility? Of course, TheStreet’s founder Jim Cramer has a rule or two about investing. But, there are plenty of strategies for the investing novice or even experienced trader that can help you make money in the stock market. Whether you’re a first-time investor or a market veteran, TheStreet has compiled expert’s top tips and strategies for making a profit off the market. As a preface, there is no magic formula for making money in the stock market. But, according to experts, there are definitely ways to make it a lot easier. But, according to Loewengart, you don’t need loads of cash to start seeing returns in the market.

What are your options?

In this guide. Once you identify the offer, you can dig in and do some research — then, you can either take the deal or not. So you have to understand what you’re doing and be able to analyze the market forces and make significant gains. Think and you shall become. Live chat. You definitely do. While there are over 3, cryptocurrencies in existence, only a handful really matter today. Stamp Duty is charged at 0.

Make Money Investing in Stocks

How to Invest in Shares

Insiders and executives have profited handsomely during this mega-boom, but how have smaller shareholders fared, buffeted by the twin engines of greed and fear? Stocks make up an important part of any investor’s portfolio. These are shares in publicly-traded company that trade on an exchange. The percentage of stocks you hold, what kind of industries in which you invest, and how long you hold them depend on your age, risk toleranceand your overall investment goals.

To make money investing in stocks, stay invested

Discount brokersadvisors, and other financial professionals can pull up statistics showing stocks have generated outstanding returns for decades. However, holding the wrong stocks can just as easily destroy fortunes and deny shareholders more lucrative profit-making opportunities. Retirement accounts like k s and others suffered massive losses during that period, with account holders ages 56 to 65 taking the greatest hit because those approaching retirement typically maintain the highest equity exposure. That troubling period highlights the impact of temperament and demographics on stock performancewith greed inducing market participants to buy equities at unsustainably high prices while fear tricks them into selling at huge discounts. This emotional pendulum also fosters profit-robbing mismatches between temperament and ownership style, exemplified by a greedy uninformed crowd playing the trading game because it looks like the easiest path to fabulous returns. Despite those setbacks, the strategy prospered with less volatile blue chips, rewarding investors with impressive annual returns. Both asset classes outperformed government bonds, Treasury bills T-billsand inflationoffering highly advantageous investments for a lifetime of wealth building. Equities continued their strong performance between andposting The real estate investment trust REIT equity sub-class beat the broader category, posting This temporal leadership highlights the need for careful stock picking within a buy and hold matrix, either through well-honed skills or a trusted third-party advisor.

Comments

Post a Comment