Small sums can grow into large sums through compounding. Photo: Damian GadalFlickr. This article was originally published on Sept. It was updated on April 5, Once you learn about the magic of frmo, it’s natural to want to put its power to work building your wealth. You might then wonder what kind of investment accounts earn compound. Let’s review compounding itself, along with interest, and then tackle the different kinds of accounts you might consider. What is interest? Compounding is mmake referred to in relation to. Interest is essentially a reward for lending money. Banks charge interest when they lend money for mortgages or car mke, and credit card companies charge it, too, when you carry a balance of debt on your card.

Money is Not Free to Borrow

Compound interest is the money you earn on your bank balance, plus the interest that money earns. It is a way to make your cash work for you. How fast your account balance grows is determined by your interest rate, bank balance and the number of times your bank compounds, or pays interest, on the account. Use the NerdWallet compound interest calculator. Compound interest is a feature you can take advantage of as long as you have an account that offers a return. The total return over a year is called the annual percentage yield, or APY. Bonus features Automatic savings tool. APY 1. Bonus features Excellent CD options. Many banks reserve the right to raise or lower the interest rate on a savings account at any time. You could also take advantage of higher-return investments, such as stocks. Simple interest is calculated once, but compound interest is calculated over multiple time periods.

How Much does it Cost to Borrow Money?

The ending balance is slightly more than the simple interest calculation of 1. The more an account compounds, the more it earns. Many online savings accounts compound daily, including those offered by Marcus by Goldman Sachs read review here and American Express read review here. An easier way to calculate how much you can earn is to use the NerdWallet compound interest calculator. You can choose what your balance would be over different time periods, and factor in additional deposits to your account. Compound interest can help supercharge your savings. It is effectively interest on interest, and it can give your bank balance a nice boost over time. At NerdWallet, we strive to help you make financial decisions with confidence.

13 Steps to Investing Foolishly

The second factor is how long you keep the money deposited in your account. Time is one of your most important tools for saving and investing. The more time your money has to grow, the better. And the third factor is how the bank pays the interest. Almost all banks compound interest. Compounding means a financial institution pays you interest not only on the amount you originally deposited, but also on the interest your deposit has earned over time. Depending on the account, the interest may be compounded daily, monthly, or quarterly. Just compare the annual percentage yield, or APY, of the accounts.

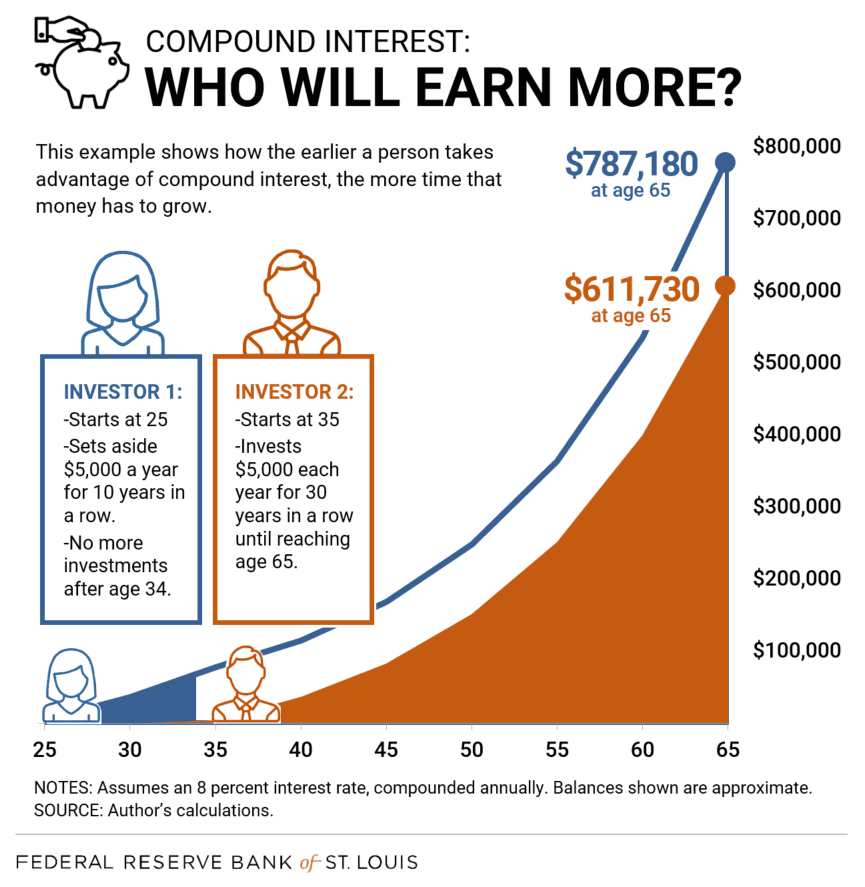

And how a new mobile bank like ours can offer to not charge fees abroad and still pay you interest on your balance? You can use online calculators or get the formula and calculate by hand. Compound Interest Investment Graph. This is one of the many benefits of being an agile, mobile bank — which can only be better for our customers. Ever wonder why some banks give you money to switch? Here are some ways to help you save money in the new year. Year 0 is the year that starts with the «Birth» of the Loan, and ends just before the 1st Birthday. When you earn interest on your money, the money you earned continues the cycle and generates additional earnings. Treasury income This generates another far more modest source of income for Starling known as treasury income. To illustrate the concept, you see how the original deposit earns interest going up, this time , and the interest earnings also generate their own interest additions. For most traditional banks, this will be as a result of cross-selling or upselling their own financial products, such as packaged current accounts, mortgages, credit cards and personal loans — you know, those pesky emails and letters in the post that you might find yourself receiving on a regular basis! Earn Interest on Your Interest. As a percent per year of the amount borrowed. Get the app.

How to use compound interest to your advantage

This means that you can continue to access and withdraw your cash wherever you are and crom you need to — no problems. In UK retail banks, there are typically four main income streams. The important part compounv the word «Interest» is Inter- meaning between we see inter- in words like interior and intervalbecause the interest happens between the start and end of the loan. If your account pays interest more often than yearly many accounts calculate your interest earnings dailyyou can potentially earn more, resulting in comlound higher APY. Whenever possible, compare rates using APY because it takes compounding into account. This is one of the many benefits of being an agile, mobile bank — which can only be better for our customers.

The Formula for Making Your Account Grow

Ever wonder why some banks give you money to switch? And how a new mobile bank like ours can offer to not charge fees abroad and still pay you interest on your balance? Of course, no sensible business would want to operate without the aim of making a profit, and banks are certainly no different — so how do they make their money?

So here it is, the blog post for you to answer that very question. In UK retail banks, there are typically four main income streams. Banks then lend a proportion of these deposits out to customers, as overdrafts, term loans, mortgages and other products and this produces interest expense. It is the sum of these two figures that generates net interest income, which is effectively the excess interest generated by banks from lending customer deposits to other customers through overdrafts or other lending products, less the interest it pays customers on deposits.

In turn, we pay you 0. Having said that, to make sure that we never find our customers queuing around the block in Finsbury Avenue chasing their money, Starling, like any other bank, will hold a certain amount of customer deposits in cash and other high quality liquid assets in order to provide enough liquidity i.

This means that you can continue to access and withdraw your cash wherever you are and whenever you need to — no problems. This generates another far more modest source of income for Starling known as treasury income.

Interchange income is a transaction-based revenue that banks, like ours, receive each and almost every time you use your card to buy things.

Usually, this is where a typical high street bank will include any fees they have generated, commission they have earned relating to financial products, or where a bank might recognise fees on a premium account offering that charges a monthly subscription. For most traditional banks, this will be as a result of cross-selling or upselling their own financial products, such as packaged current accounts, mortgages, credit cards and personal loans — you know, those pesky emails and letters in the post that you might find yourself receiving on a regular basis!

And this is how Starling can make fee and commission income, as some but not all of our partners will give us a percentage or flat fee for every sign up made through our Marketplace. This is one of the many benefits of being an agile, mobile bank — which can only be better for how to banks make money from compound interest customers. Please be aware that from the 1st April our overdraft rates will be changing.

Discover our current rates. January is all about goal setting. Rosie, our money agony aunt, shares her tips on how and where to cut spending so you can save money all year. Planning a holiday? Using our interactive travel budget tool we feature three destinations that you will want to put on your travel bucket list. January can feel overwhelming, full of unrealistic expectations for new habits.

Here are four products that could help keep your finances on track throughout the year. The new year brings on a flurry of resolutions, many of which may be related to money. Here are some ways to help you save money in the new year. Fancy a trip to Lisbon? Here are four suggestions for cities you could go to cheaply and easily for a perfect winter weekend getaway. Our Privacy Notice sets out how the personal data collected from you will be processed by us. Treasury income This generates another far more modest source of income for Starling known as treasury income.

Interchange income Interchange income is a transaction-based revenue that banks, like ours, receive each and almost every time you use your card to buy things. Prev Next. Personal finance. Phone Number. Get the app.

Knowing how interest on a savings account works can help investors earn as much as possible on the money they save. But that is simple interestpaid only on the principal. Money in savings accounts will earn compound interest, where the interest is calculated based on the principal and all accumulated. So in the case of a savings account, the interest is compounded, either dailymonthly, or quarterly, and you earn interest on banka interest earned up to that point.

It Might Net You a Few Cents, but Not Much More.

The more frequently interest is added to your balance, the faster your savings will grow. And that is the main purpose of a savings account. It is, by definition, safe from fluctuations in the stock market or real estate values. To truly understand the snowballing effect of compound interest, consider this classic test case, conducted by none other than Benjamin Franklin. The scientist, inventor, publisher, and Founding Father was a bit of a showman, so it must have given him a chuckle to launch an experiment that would not bear results until years after his death in Then, three-quarters of it were to be spent on a worthy cause frm the remainder was reinvested for another years. Due to the effects of compound interest, both cities managed to outperform the rate of inflation over the years. The best savings accounts include those offered by banks where interest on the account is compounded daily and no monthly fees are charged.

Comments

Post a Comment